The Skilling Australians Fund legislation has just been passed in the Senate.

The Australian Government has stated that the purpose of the Skilling Australians Fund (the Fund) is for it to provide ongoing funding for vocational education and training (VET). The Fund is supposed to support 300,000 more apprenticeships, traineeships, pre-apprenticeships, pre‑traineeships, and higher apprenticeships all across Australia.

The revenue for the Fund will be financed by the Government’s skilled migration reforms that require employers who sponsor a foreign worker to pay a Nomination Training Contribution Charge (known as a levy) under the following visa types, including:

- Temporary Skill Shortage (TSS) visa

- Employer Nomination Scheme (ENS) (subclass 186) visa

- Regional Sponsored Migration Scheme (RSMS) (subclass 187) visa

The levy has replaced the previous training benchmarks for employers who sponsor foreign workers on the above mentioned visas.

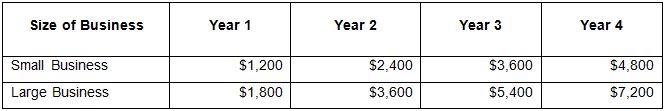

The new levy is payable by companies sponsoring overseas candidates for subclass 482/TSS visas and subclass 186 visas. The new system is a simpler one and for many employers it will be easier to meet and to administer. The training levy will be payable per application and at the nomination stage of the visa process. For each person an employer sponsors they will pay a set amount per year. The other relevant fact is the size of the employer’s business or more specifically the size of their sales turnover or revenue. There will be one levy for employers with a turnover of less than $10 million and a higher amount for employers with a turnover of $10 million and above.

The amounts for a TSS/ subclass 482 visa are:

For permanent residence employer sponsored applications – visa subclass 186/187. The permanent application figure is a higher payment bit it is one off payment and paid not annually:

- If turnover less than $10 million – $3000

- If turnover $10 million or higher – $5000

Some good news is that the levy will be tax deductible and if a nomination is refused or where an incorrect application is lodged and withdrawn, the levy will be refunded. However the cost of Skilling Training Fund levy cannot be passed on to the visa applicant.

If you need more information on SAF, call one of our Lawyers and Agents for a consultation.